9 Factors To Help You Pick The Right Pet Insurance Provider

If you're on the fence regarding pet insurance, we get it - there's so much fine print and red tape to consider! So here's how you can ensure your buddy has access to the best medical care with the right pet insurance policy.

Just like us, our pets can fall ill or have accidents – so it’s essential to be prepared for unexpected vet bills. That’s where pet insurance comes in. With the right coverage, you can ensure they get the care they need without breaking the bank. In this post, we’re going to guide you through the 9 key factors you might want to consider when selecting the purr-fect pet insurance policy for you.

Find out where your cat spends their time.

Read moreChoosing pet insurance: 9 factors to consider

Choosing a pet insurance policy that fits your needs comes down to more than just the price or coverage limits. Here are nine important things to consider when choosing the right pet insurance provider.

1) Your pet’s needs and risks

When choosing pet insurance, the first most important factor to consider is your pet’s unique situation and needs. Your pet’s age is important, as it may become more challenging to find coverage for older pets (typically over eight years old for dogs and cats) or very young pets (under eight weeks old). This is why it can be helpful to get them insured before they reach these age thresholds.

You should also consider your pet’s breed, and which health conditions they may be susceptible to. For example, whilst Labrador Retrievers are the most popular breed of dog in the UK, many of them are born with elbow and hip dysplasia, which can cause skeletal problems as they get older.

Next, think about your pet’s existing medical conditions. If your pet has a pre-existing condition, it will be important to find a policy that covers it – or else know the policy limitations.

Finally: as much as your pet loves you, are they at risk of harming others? If so you might want to get a pet insurance policy that includes third party liability.

Read more: Why You Should Consider Pet Insurance For Older Dogs

2) Your budget & where you live

Besides your pet, consider other personal factors such as your budget and where you live. How much are you willing to spend on a pet insurance premium each month or year? Or how much can you afford to pay for vet expenses out of pocket, with or without insurance?

Similarly, where you live can affect the price and availability of veterinary services in your area. Pet insurance is especially helpful in areas where veterinary care is more expensive. In fact, one study found that vet fees vary drastically from place to place in the UK.1 For those facing high vet fees, pet insurance is a great option. In fact, your pet insurance provider will even take into account your location when calculating the premium for your pet.

Read more: How Does Pet Insurance Work? A ‘Paw by Paw’ Breakdown

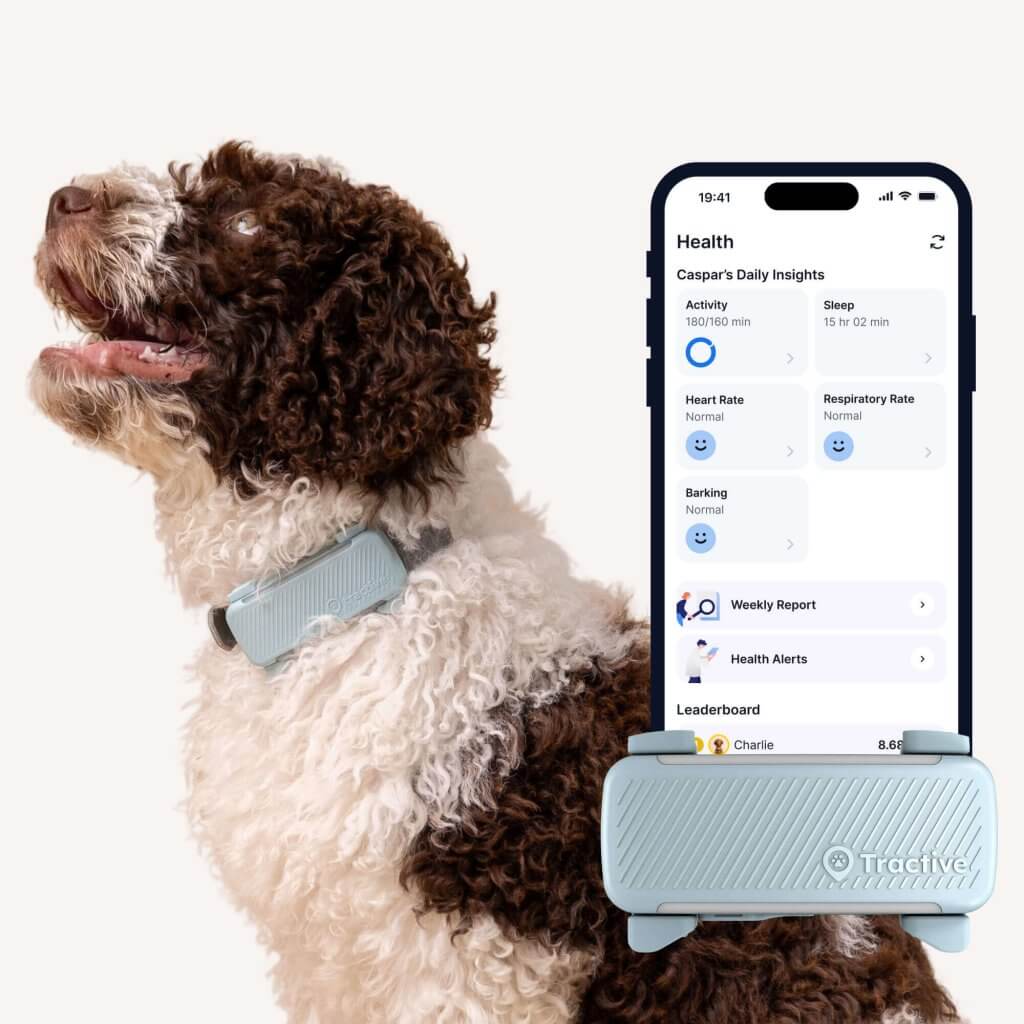

Get health alerts for your dog

Our pups can’t always tell us if something’s wrong. But if their tracker detects unusual changes in their routine, you’ll get an alert, helping you catch potential issues early.

3) Types and number of pets

What type of pet do you have? While most policies focus on dogs and cats, there are also insurance options available for horses, rabbits, birds, and exotic pets. If you have multiple pets, it’s worth considering a policy that covers them all to potentially receive a discount. Insurers may sometimes limit the total number of pets you can insure at any one location or address. This is to limit concentration of risk and their overall exposure.

4) Coverage options & limits

When exploring pet insurance providers, it’s crucial to understand the coverage options and limits offered. Each company has different plans and policies, so take the time to review them thoroughly. Look for comprehensive coverage that includes veterinary fees, accidents, illnesses, and even specialized treatments like dental care or behavioral therapy.

⚠️ Also be aware that something like dental care must be connected to an underlying illness or accident; simply having a tooth removed because it needs to come out may not be covered.

Consider your insurance policy limits as well. Some insurers offer a maximum payout per condition, while others have an annual limit. Ensure the policy provides adequate financial protection for your pet’s potential healthcare needs.

Read more: The Main Types Of Pet Insurance: Which Works Best For You?

5) Exclusions & waiting periods

It’s essential to fully understand any exclusions or waiting periods that may apply to the policy.

- Exclusions typically include pre-existing conditions or hereditary conditions common to certain breeds.

- Waiting periods can range from a few days to several weeks before the coverage becomes effective.

By carefully reviewing these aspects, you can avoid any unpleasant surprises when submitting a claim.

6) Excess, premiums & co-insurance

Pet insurance policies usually involve excesses and premiums.

- An excess is the amount you will need to pay out of your pocket before the insurance coverage kicks in.

- Premiums are the regular payments you make to maintain your policy.

Consider your budget and evaluate how excesses and and premiums fit within it. Sometimes, choosing a higher excess can lower your monthly premiums, but ensure it remains affordable in case of an emergency.

In addition to the excess referred to above, there is sometimes a “co-insurance” element too. This is essentially another excess, and it means that you will also be required to pay a certain percentage of each claim. Insurance policies that appear quite cheap and offer low premiums often have a much higher co-insurance component, so watch out for this!

7) Claim process & customer service

A seamless and efficient claim process is crucial during stressful times when your pet needs medical attention. Research the pet insurance provider’s claim process to understand if it aligns with your expectations. Consider factors such as online claim submission, direct payment to the veterinarian, and prompt response times.

Additionally, excellent customer service is essential for a smooth insurance experience. Look for providers with positive reviews, accessible customer support channels, and knowledgeable representatives who can address your concerns and provide guidance when needed.

8) Customer reviews and reputation

Before finalizing your decision, take a moment to check customer reviews and the reputation of the pet insurance provider. Look for feedback on their claim approval process, responsiveness, and overall satisfaction levels. Reading about other pet parents’ experiences can give you valuable insights and help you make an informed choice.

9) Additional benefits and services

Some pet insurance providers offer additional benefits and services that can enhance your coverage. These may include coverage for:

- Complementary therapies

- Behavioral consultations

- Boarding fees in case you’re unable to care for your pet temporarily

- Veterinary fees abroad

- Holiday cancellation costs in case your pet falls ill

- Loss from theft, loss or death

- Advertising and reward if you pet should go missing

While not essential, these perks can add value to your policy and make a difference in certain situations.

Our top tips for choosing the right pet insurance policy

- Insure your pet when they’re young and healthy. It tends to become more expensive and harder to find coverage as they age or develop health issues.

- Choose right the first time. Changing policies can come with certain downsides (like previous medical conditions not being covered anymore) so choose wisely when it comes to pet insurance.

- Don’t make your choice based on price alone. There are more factors to consider than just price alone. Choose the type of pet insurance that will best meet your needs and your budget.

- Read the fine print. Take your time to read the terms & conditions before you agree to a pet insurance policy so there will be no unpleasant surprises later on.

- Don’t just choose the plan with the highest payout limit. Knowing that your policy will cover a large amount of vet fees per incident or year is reassuring, but it’s not everything. Make sure your plan includes all the benefits you want (and maybe even more) rather than looking at vet fee benefits alone.

Wrapping up: What to look out for when picking an insurance provider

Choosing the right pet insurance provider isn’t an easy decision – but it’s one your furry friend will thank you for. Because with all the love they give us, they deserve nothing but the best possible care.

So if you’re wondering how to pick a pet insurance provider, look out for factors like:

- Your pet’s needs, including their age, general health, and breed

- Your budget and where you live

- What type of coverage your insurance provider offers

- What conditions or breeds might be excluded from your insurance policy

- The insurance provider’s customer service and reputation

With these in mind, you can make an informed choice that meets your unique needs – and secure your peace of mind for good.

Read more: Benefits Of Pet Insurance: Is It Worth The Investment?

This post was written by Frank Speight, a veteran of the insurance industry, who’s worked in financial services for more than 30 years across Europe and Asia. Besides negotiating the best possible insurance products for pet parents, he’s also dad to two Golden Retrievers – who have a larger following on Instagram than him!

When he’s not busy with Tractive, you can find him walking his dogs on the beach, managing their social media accounts, or playing the guitar.